The Magnificent Seven was a classic 1960’s Western film about seven gun slinging cowboys who are hired to protect a Mexican village from a group of bandits. The cast included the likes of Yul Brynner, Steve McQueen, Charles Bronson and Robert Vaughn. The film won critical and commercial success and has been appraised as one of the greatest films of the Western genre.

The term “Magnificent Seven” has also been used in the financial world to refer to a group of large, influential and well-established technology companies that are currently dominating the stock market. These include Apple, Amazon, Google, Microsoft, Tesla, Nvidia and Meta.

The “Nifty Fifty” was another group of companies that dominated the stock market during the 1960’s and 1970’s. These stocks were known for their stability and strong growth potential. They were “one-decision” stocks, meaning you could buy them and hold them indefinitely. Does this sound familiar? Some of the stocks in the Nifty Fifty included IBM, Coca-Cola, Disney and McDonalds. But eventually, there was a significant market correction and many investors who had piled in at lofty valuations experienced significant losses!

What caused the correction that bought down the Nifty Fifty? There were a number of factors – over valuation being the primary one with buyers paying over the top price-to-earnings multiples that were way higher than market norms. At the same time inflation was rising in the United States, which eroded the purchasing power of consumers and also led to rising production costs. As inflation increased, so did interest rates. Higher interest rates make stocks less attractive relative to fixed income investments, which contributed to selling pressure on high priced stocks. With higher inflation and interest rates came an economic slowdown and again, investors wondered whether the high growth would be possible for these companies. As the Nifty Fifty stocks disappointed on their earnings, investors realised that the multiples were not justified, their confidence was eroded, and they began to sell down the stocks.

They say that history doesn’t repeat itself, but it rhymes. The Magnificent Seven seem to be rhyming with the Nifty Fifty at the moment, and caution is warranted when investing in these companies. It is not to say that they are bad investments, but there is always a right price for a company or asset. The valuations of these stocks are high and although so much is different to the 1960’s and 70’s, we are in a similar environment of rising inflation and interest rates, and slowing growth. The big tech companies are part of our lives in so many ways – all with a common theme of mobile connectivity. These companies are not going to disappear or fail, but when investors price in high growth in perpetuity, something has to give. I am not sure when it will happen, or what the catalyst will be, but I do think that the market will correct at some point and there will be some pain felt. Having said that, not all companies are over-valued – there is much research about the breadth of growth in this market – let me know if you’d be interested in hearing more about that!

One thing to remember at times like this is that as painful as it can feel while you are sitting in the middle of the bad news, is that good companies will survive and grow over time. I read this during the week and it is a great comfort when investing in uncertain times:

Equity bulls justify these rich valuations with three arguments: (i) the Fed will pull off a soft landing, (ii) if growth does falter, the Fed will ease aggressively, (iii) new technologies will deliver productivity and profits.

The problem with these arguments is history. Soft landings are rare. After 2000, when activity slowed, the Fed did ease aggressively, but its rate cuts failed to prop up the equity market. And the new technologies that drove the late-1990s bull market did—eventually—deliver enormous profits. But buying Amazon for US$5.30 at the end of 1999 would still have been a painful mistake; a year later it was offered at less than US$1.

Just by the way … Amazon is trading at $130 today, but they had a 20 to 1 stock split in 2022 which means that the equivalent share price would be about $2,600. Even if you had bought he stock a the high price of $5.30 in 2000, you’d still be happy with the return!! That is a total return over 23 years of 48,956%!! The annualised return is 31.91%. This is also a great example of the effect of compounding! September was not a great month for markets around the world! I am not sure that October is going to be much better, but interestingly, over many years, September has been a worse month than October for returns. And typically there is a rally into the end of the year – so here’s hoping!!

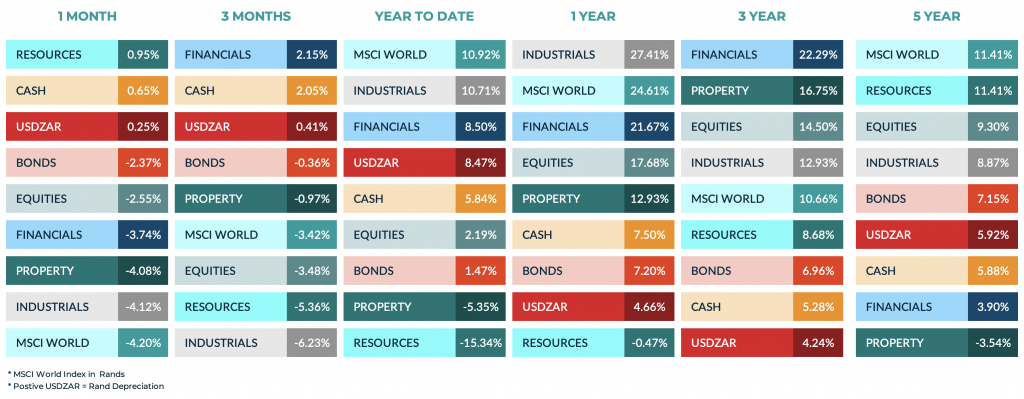

Asset Class Returns

The table below represents a rolling year view of the major asset class returns that we track. It offers a view of the asset classes we use to diversify your portfolio.